Automation of warehouses and logistics platforms

1. Rampant automation

Since 2012, the trend towards mechanization and automation of logistics operations has only increased in France: between 2015 and 2017, 59% of EPLs introduced at least one new piece of equipment that enabled them to modify their logistics procedures and their performance ; 73% are equipped with warehouse management computer software such as WMS (Warehouse Management System).

If in 2016, only 5% to 10% of EPLs were automated, their march towards automation has considerably increased in recent years, boosted by the health crisis and the rise of e-commerce (home delivery, drive. ..) that followed. Mechanization, robotization and automation are today drivers of value creation for companies that have taken the proper measure of the contribution of robotics to logistics sites. The global warehouse automation market is estimated to double by 2025.

Composite portrait of the EPLs in France [i]

In mainland France, there are 4,054 warehouses or logistics platforms (EPL) of more than 5,000 m² totaling 76 million m² (2016 figures). For the majority, they are exploited on their own account.

With an average surface area of 18,600 m², EPLs generally measure less than 11,300 m² (for half) while the largest exceed 100,000 m².

72% store goods between one week and three months; 11% more than 3 months.

The EPLs are concentrated in the northern half of France and in Auvergne-Rhône-Alpes.

Increased flexibility to adapt to new demands

Guaranteeing customer satisfaction through an optimal quality of service remains the main motivation that encourages companies to automate their logistics. The automation of EPLs makes it easier to manage heterogeneous and therefore more complex flows (increased number of references, smaller but more frequent orders, increasingly tight delivery times, etc.) and to drastically limit the risk of human errors. The supply chain sees its productivity improved (acceleration of rates, reduction of non-productive times), as well as its flexibility (to cope with peaks in activity, machines can operate 3x8, 24/24h, 7/7d) [ii ] .

For businesses, automation is a way of alleviating the labor shortage, particularly among forklift drivers, but also the ever-increasing cost of renting warehouses, mainly near large cities. On a human level, automation contributes to the greater safety of operators (limited risk of accident), to their comfort (reduction of the arduous nature of the work) and to their development since they are assigned to tasks with greater added value.

Automation: various solutions [iii]

Fixed equipment : automatic storage systems (trans-storers), automated conveyors, intelligent sorting systems, mobile shelves, handling and unloading robots, cobots, depalletizers, order preparation assistants, automatic bagging machines, etc.

Mobile equipment : self-guided trucks (AGV and AMR), forklifts, combined trucks, automatic pallet trucks, robotic arms with dedicated tools, connected objects, connected glasses, inventory drones, etc.

Management software : WMS tools for better quality of customer service, optimal use of material and human resources, improved traceability, localization and control, and therefore real-time visibility of inventories, costing of performance indicators, easier decision.

Despite the real benefits, obstacles remain

It is difficult to predict what the supply chain will look like 10 years from now, so some EPLs are still hesitant to invest in automation solutions with too long a return on investment. They are turning instead to agile solutions (articulated robotic arms, etc.) or to RaaS (Robotics as a Service), a rapidly developing model of access to robotization. The same monthly package gives access to the latest generation hardware, as well as its maintenance, associated services and necessary upgrades. This “all-inclusive” subscription model, already well established for other technology solutions, is increasingly attractive given the rapidly evolving level of technologies used in mobile pallet and load handling automation. unitary.

Another obstacle to the automation of EPLs: the available space. Automating an EPL requires large areas and most warehouses have been designed using a manual approach. They therefore do not allow a heavy automated installation, just an extension when possible or even an installation in pick towers.

Prologis reports higher inventory requirements, a substantial increase in the number of square meters sought and strong demand for the most strategic locations. In Q3 2021, Europe saw a record vacancy decline of 3% and this persistent space shortage could worsen further in the coming months [iv] .

2. Ever more innovative technologies

While warehouses make easier use of automation and robotics technologies, the processes deployed there are always more innovative. Some large companies do not hesitate to buy manufacturers or start-ups to then use for their exclusive use their solutions and/or logistics tools that perfectly meet their needs. Others play the co-creation card by approaching specialists with whom they design and manufacture specific tools.

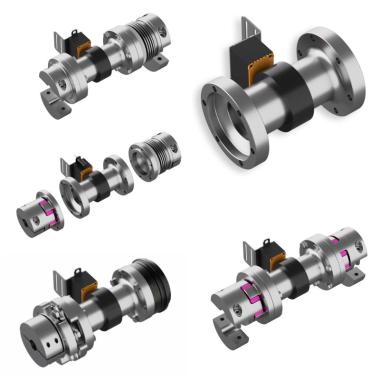

In terms of lifting and storage handling equipment, fully autonomous forklifts and autonomous mobile robots (AMR) are particularly dynamic.

Forklifts: a growing market

The situation in the global forklift market worsened at the beginning of 2019: fearing a recession, companies delayed planned investments. In addition, in the first months of the health crisis, orders fell by up to almost 70% year-on-year. Order intake rose sharply as manufacturers responded to an unprecedented e-commerce boom [v] .

Unfortunately the blockage in the supply chain prevented the shipment of a significant number of forklift orders. This lag between orders and shipments has widened due to raw material shortages and logistics price increases, not to mention labor shortages and energy supply issues.

The global compound annual growth rate between 2021 and 2030 is estimated at 6.1%, with global annual sales exceeding 3.4 million forklifts by 2030. To some extent, the strong rebound in 2021 has lifted the basis for growth over the next decade as a whole. Thus, the shipping forecast for 2021 is 20% higher than that of 2020; those for 2028, 39% higher.

The AMR boom

Fundraising, strategic takeovers, the global sector of autonomous mobile robotics (AMR) is getting structured. Estimated at $1 billion in 2020, it should reach nearly $10 billion in 2025 (Interact Analysis), boosted by the Covid-19 crisis and the rise of e-commerce, but also by the quest for industrial flexibility and the technological advances in this sector [vi] .

The AMR wave is sweeping through logistics sites. Capable of following any route and finding their bearings in complex environments, AMRs are much more flexible than their predecessors, the automatic guided vehicles (AGV), constrained by trajectories defined in advance. In addition, they adapt to the configuration of the site and do not require any costly modification of the installations. Economically more affordable, they can be deployed quickly to support heavier automation systems. “With AMRs, all you have to do is define a map and navigation rules, and the robot can move there. It's the equivalent of a taxi, where AGVs operate more like buses: just call it when needed, and it takes care of everything,” as one manufacturer executive put it. of AMR, quoted by L'Usine Nouvelle. [viii]

Different sizes and varied shapes depending on the intended uses, not all AMRs are alike. The largest ones are dedicated to moving heavy pallets while large swarming fleets of autonomous vehicles are reserved for individual objects. Storage, bin transport, parcel sorting, mobile shelving, moving heavy loads… the market is very diverse.

At the same time, manufacturers of handling, lifting and storage machinery face a double challenge: to develop "green" solutions that reduce the carbon footprint, pollutant emissions and noise, in order to comply with environmental directives , while offering their customers economically accessible products that meet their efficiency and durability requirements. In this field, the hydrogen/fuel cell alliance would represent the most competitive development, in particular for forklifts [viii] . To be continued...

[i] Warehouse and logistics platform activity in 2016: still emerging automation , General Commission for Sustainable Development, March 2019

[ii] The future of the warehouse will be automated or it won't be [Analysis], LSA, 2019-03-19

[iii] Radar of emerging solutions in logistics robotization , Wavestone, 23/10/2019

[iv] Persistent Disturbances, Special Research Report, Prologis, November 2021

[v] Long-term forecast of forklift market in 2028 raised by 40%, Materials Handling, 11/11/2021

[vi] Watch note - Innovative mobile robotic solutions and autonomous MLS machines , Cetim, 01/10/2021

[viii] Between fundraising and strategic takeovers, autonomous robotics is taking shape , L'Usine Nouvelle, 07/21/2021

[viii] Watch note - Hydrogen, a winning option for forklifts , Cetim, 05/20/2021

Our other news

See allJoin the largest community of industrial suppliers

- Helping you with your ongoing technology watch

- Provide you with detailed supplier statistics

- Give you international visibility

Discover the largest catalogue of industrial products on the market

- To offer you the best catalogue of industrial products on the market

- To guarantee you a 100% secure platform

- Enable you to have live remote exchanges

Français

Français